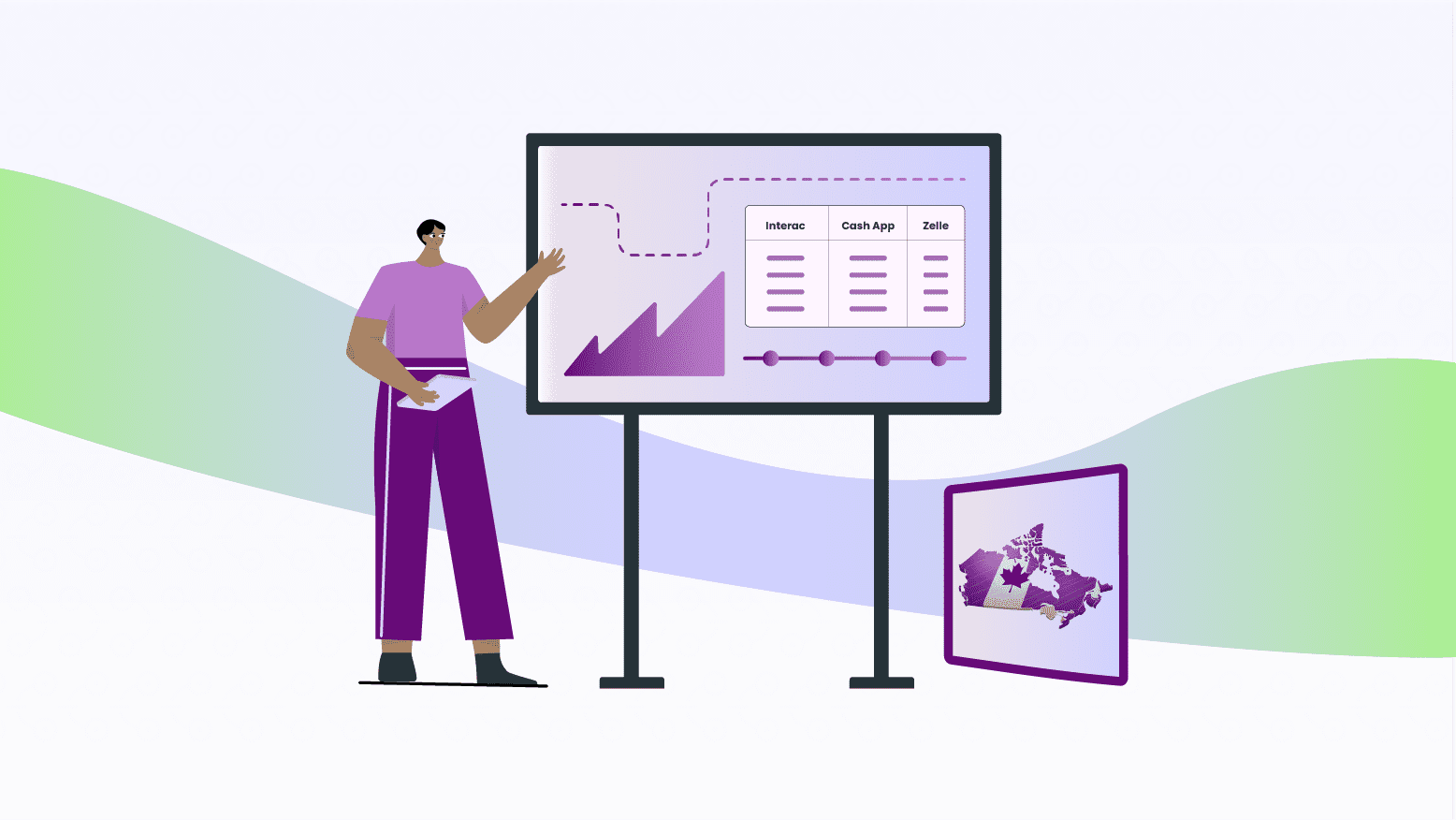

Interac vs. Zelle vs. Cash App: Navigating the Canadian Payment Landscape

Introduction

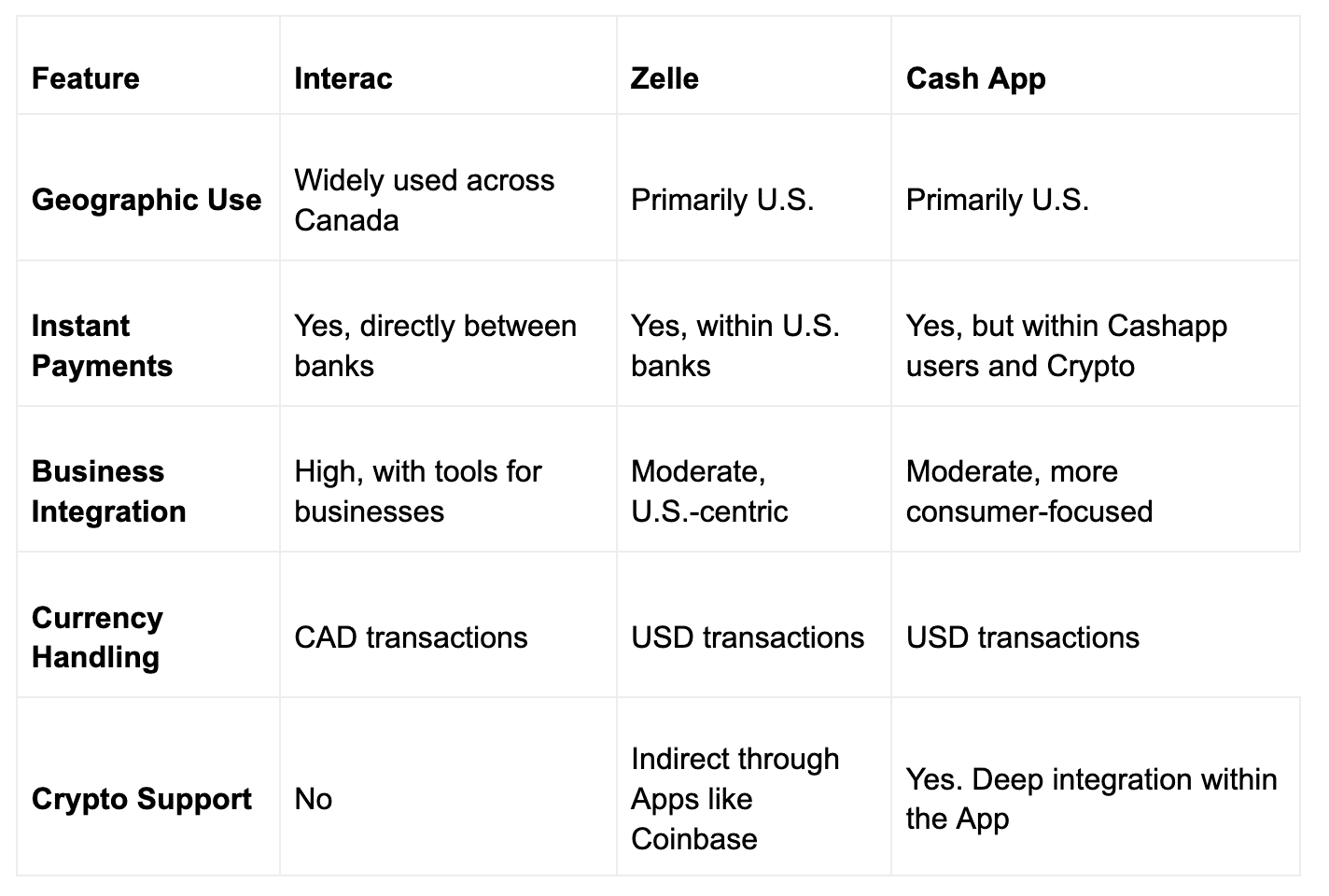

From growing up in Nigeria to completing University in Canada to working in San Francisco, and now building a Start in Toronto, Canada, I’ve seen firsthand how the right payment solutions can transform businesses and personal transactions. In this blog post, we will dive into a comparative analysis of three major players in the payment space: Interac, Zelle, and Cash App. Each platform offers unique advantages, but for Canadian users and businesses looking to expand or streamline their payment processes especially locally, understanding these differences is key.

Interac: Canada’s Homegrown Solution

Interac stands out as a distinctly Canadian solution, deeply integrated into the financial ecosystem of the country. It allows users to send money directly between bank accounts without intermediary steps, making it highly trusted for both personal and business transactions. Here’s what Chimoney brings to the table with Interac API offers:

- Instant Payment Acceptance: Businesses can receive payments up to $10,000 instantly, significantly speeding up cash flow.

- Bulk Payout Capabilities: Ideal for paying out gig workers or distributing prizes, Interac enables mass payouts directly to recipients' bank accounts via email. Check out our blog post to learn how to send Interac Bulk Payouts via API.

- Payment Requests: Simplify billing by requesting payments directly via email with instant payment through Interac, ensuring timely receivables. In addition to the Interac Request Money Feature, you can also use Chimoney’s Payment Request Feature which allows you to request Money and gives the payer the option to pay with Interac, Card, Bank transfer, and other options.

Zelle: The American Connection

Originally designed to compete with the likes of PayPal and Venmo, Zelle is embraced primarily by U.S. banks, offering seamless transactions without fees. While it facilitates instant transfers among U.S. bank accounts, its integration in Canada is limited, as it requires U.S. bank partnerships.

Cash App: Flexibility in Payments

Cash App has revolutionized the peer-to-peer payment landscape by allowing users not only to send and receive money but also to invest in stocks and cryptocurrencies. Although popular in the U.S., its functionality in Canada is constrained by regulatory and financial infrastructure differences.

Analysis of Payment Options

The Power of Instant Confirmation

Imagine a Canadian online platform, "Maple Goods," which used to wait days to confirm payments from international buyers—slowing down both their operations and delivery times. After integrating Chimoney's Payment Infrastructure, Maple Goods now confirms payments up to $10k instantly. Their buyers pay with their local currency with Card or Bank Transfers, powered by Chimoney, and Chimoney disburses the funds locally to Maple Goods via Interac the same day. This shift not only improves their operational efficiency but also enhances customer satisfaction by speeding up order processing times.

Use Cases of Interac

Interac’s flexibility and integration into the Canadian financial ecosystem make it a versatile tool for various transactions. Here’s how Chimoney Infrastructure with Interac support and Infrastructure can enable these use cases:

Rent Payments

-

- Scenario: Property management companies can collect monthly rent directly from tenants’ bank accounts using Interac.

- Chimoney’s Role: Automate rent collection processes, reducing administrative overhead and ensuring timely payments.

- API Link: Chimoney API for Initiating Payment Request

- Scenario: Property management companies can collect monthly rent directly from tenants’ bank accounts using Interac.

Freelance and Gig Worker Payouts

-

- Scenario: Platforms that hire freelancers for projects need an efficient way to distribute payments upon project completion.

- Chimoney’s Role: Enable instant payouts to freelancers' bank accounts, enhancing satisfaction and trust.

- API Link: Chimoney Payouts to Interac API

- Scenario: Platforms that hire freelancers for projects need an efficient way to distribute payments upon project completion.

E-commerce Transactions

-

- Scenario: Online retailers require a secure method for customers to pay for goods instantly.

- Chimoney’s Role: Provide e-commerce platforms with a secure, instant payment gateway using Interac, minimizing fraud and chargebacks.

- API Link: Chimoney Create Payment Link API and Chimoney’s Payment Collection Widget

- Scenario: Online retailers require a secure method for customers to pay for goods instantly.

Tuition Fee Payments

-

- Scenario: Educational institutions often receive payments from both local and international students.

- Chimoney’s Role: Facilitate seamless tuition fee transactions, offering a straightforward solution for students to pay their fees on time, locally via Interac, and internationally via local options. And settle the Educational Institution quickly via Interac.

- API Link: Chimoney Education Payment Solutions

- Scenario: Educational institutions often receive payments from both local and international students.

Donations and Fundraising

-

- Scenario: Non-profits and charities need a reliable method to accept donations without high fees.

- Chimoney’s Role: Enable charities to receive donations directly through Interac, ensuring more funds go directly to their causes.

- API Link: Chimoney for Non-profits

- Scenario: Non-profits and charities need a reliable method to accept donations without high fees.

These use cases illustrate just a few of the ways that Chimoney leverages Interac to provide robust, flexible, and instant financial solutions for a variety of sectors. To explore more about how Chimoney can integrate with your existing Payment Flow, visit our Product Page or Chimoney Developer Documentation.

Conclusion

For Canadian businesses and platforms, Interac offers a tailored, robust solution that integrates seamlessly with the banking system, providing both security and efficiency. Platforms like Zelle and Cash App, while powerful in the U.S., face limitations in Canada due to the specific financial and regulatory landscape.

The comparison of the Payment systems in Canada and the US lays a foundation for additional articles I will write about Payment systems across different countries. Stay tuned.

And don’t forget to visit Chimoney’s official website to learn more about how our Payment Infrastructure and API which has Interac payout and collection support can transform your transaction processes today!

Check out these other posts

Why 2025 Is The Year AI Agents Get Their Own Wallets (And Passports)