An Inside Look at Chimoney’s Interledger Integration: Results and Impact So Far

A world without financial borders, where money moves as effortlessly as an email, this has always been the Chimoney vision. Today, we're celebrating a major milestone on that journey: the successful completion of our Interledger Foundation partnership prototyping project.

For the past year, we've been working tirelessly to integrate the Interledger Protocol (ILP) into our platform, turning a bold vision into a tangible reality. We approached this project not just by adding new tools, but by securing the infrastructure needed for a truly open and inclusive financial future. Now, with our infrastructure live and regulatory foundation secured, we're ready to scale.

So, how did we get here? And what does this mean for you, our users and partners? Let’s dive in.

A Vision for a Connected World

The journey to an open, global payment network is filled with challenges. Cross-border payments are often slow, expensive, and fragmented. Our goal was to build a “fintech-in-a-box” solution that's modular, interoperable, and developer-friendly, with Interledger built right in.

Throughout this project, we focused on three key objectives:

- Simplify cross-border payments for everyone.

- Simplify developer access to ILP-based financial tools like Rafiki

- Empower individuals and businesses in underserved markets.

We’re incredibly proud to say we've not only met these goals but have already begun to see their impact in the real world. Our team successfully deployed the latest version of Rafiki v1.1.2-beta (latest version at time of implementation), built new APIs for creating and transferring funds to Interledger wallet addresses, and launched our very own consumer app, the Chimoney App. This positions us as an ILP-powered wallet for Canada and the global diaspora. It’s now easier than ever to send money to anyone, anywhere, using just a wallet address.

Our Journey, by the Numbers

The true measure of our success lies in the progress we've made and the people we've impacted. This project has been a story of rapid growth and foundational achievements.

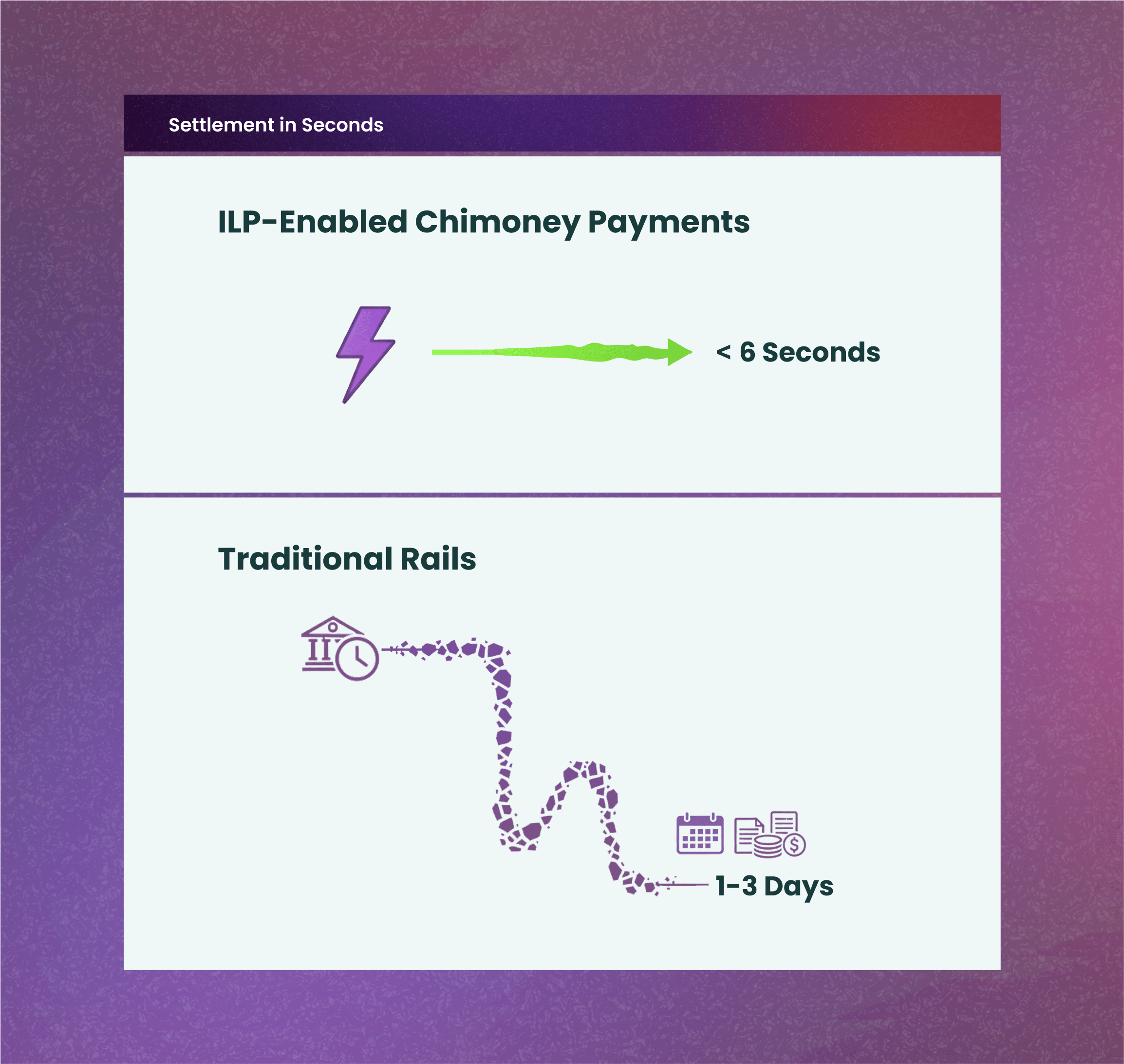

- Transactions in under 6 seconds! Our Interledger-enabled transactions consistently settle in a fraction of the time it takes for traditional payment rails.

-

Over 5,000 wallet addresses have been generated in our sandbox, showing strong traction from developers using our new Dev Portal and API documentation, while more than 170 Interledger-enabled wallet addresses were created in production during our soft launch, demonstrating strong initial demand for ILP-native wallets.

-

We've signed four new integration contracts with partners across the Caribbean, Canada, and Africa, all powered by our new Interledger infrastructure.

Our growth is more than numbers but also the tangible impact on people's lives. We've already facilitated hundreds of pilot payouts to student groups and community contributors across Africa, Latin America, and Asia. The feedback is consistent: our intuitive onboarding process and the life-changing ability to receive payments without a traditional bank account is making a real difference.

A commitment to Compliance and Innovation

In fintech, building trust is paramount. This is why a cornerstone of our project was our commitment to compliance. We aimed to not just build a new technology but also a compliant platform ready for the world.

Our efforts included:

- A comprehensive external audit to ensure our platform meets the highest standards. The implementation of enhanced Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, which are critical for the security of our Interledger wallets. Learn more about this here.

- Deep alignment with Canadian regulations, including the Retail Payment Activities Act (RPAA) and Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), with formalized reporting procedures.

- Successful compliance onboarding with regulated partners like Bitso in Mexico, which enables seamless local MXN settlement for our Interledger-connected wallets.

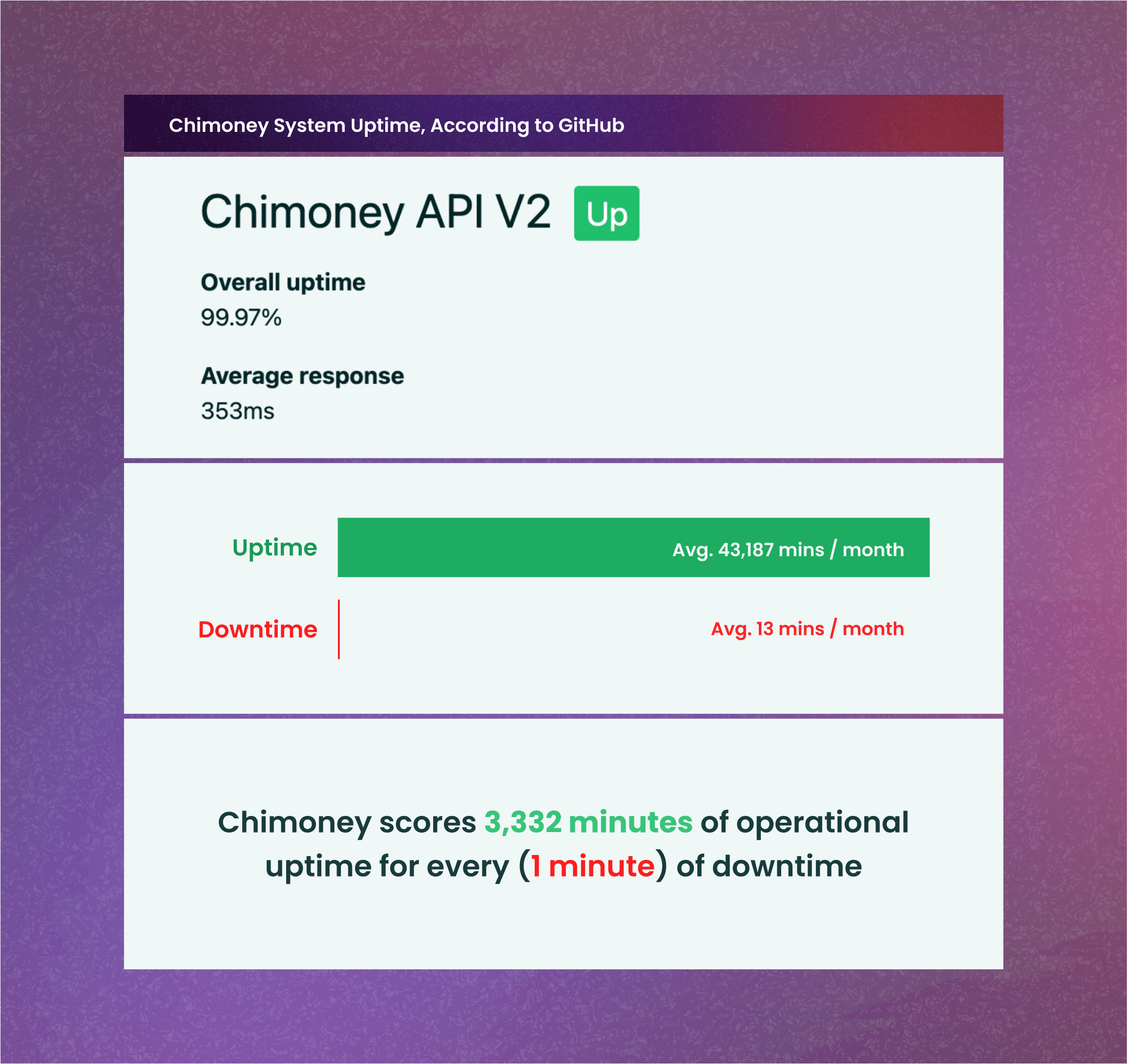

All this has helped us create a safe, secure ecosystem people can trust. We’ve also kept our deployed Rafiki instance running with a 99.9% uptime SLA to maintain that trust.

You can learn more about KYC and Compliance at Chimoney in this video.

Empowering Global payments & Web monetization

Our Interledger integration has made it easier than ever to send and receive money across borders. We've built a robust system that manages the flow of funds both into and out of the network, supporting a wide array of collection and payout options for our users:

- Collections: We enabled payments to be collected in USD (via Wire or ACH), CAD (via Interac), and NGN (via bank transfer or debit card).

- Payouts (Faster & More Diverse): Payouts can be sent via instant bank transfers to Mexico and Nigeria, Real-Time Payment (RTP) systems like SPEI in Mexico and Interac in Canada, and even Mobile Money in 13 countries across Africa.

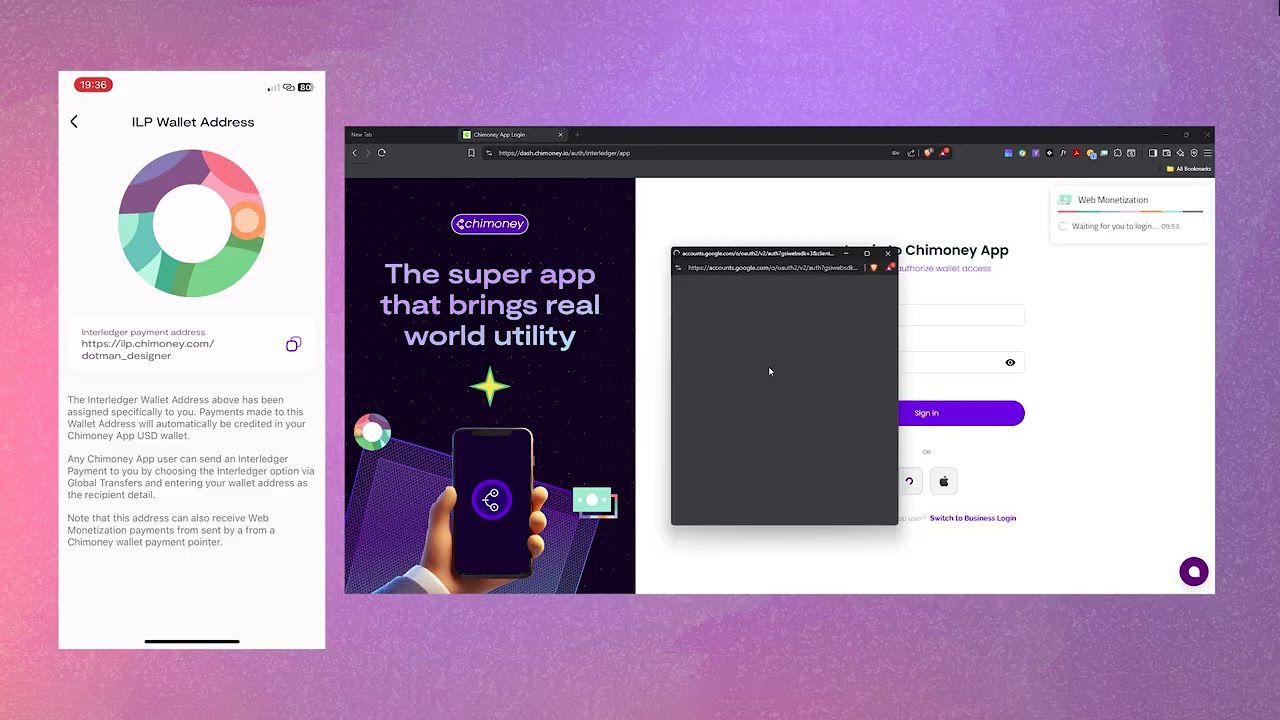

Beyond traditional payments, we’ve enabled new possibilities for the digital economy. We have successfully implemented a comprehensive identity authentication and verification system that allows Chimoney App users to participate in Web Monetization.

This enables creators to earn micropayments directly from their websites and digital content, providing a new way to monetize their work and receive payments without a traditional bank account.

You can watch our demos to see it in action:

- How to connect your Chimoney App wallet to the Web Monetization extension

- The Web Monetization payment flow within the Chimoney ecosystem

The Road ahead: Scaling our impact

The completion of this prototyping project now allows us to move from a proven prototype to a fully operational, scaled-up service that will truly revolutionize global payments.

Our vision for what's next includes:

- Launching Interledger Infrastructure as a Service (IIaaS) to General Availability (GA) at the upcoming Interledger Summit. IIaaS is our solution to simplify how other companies and financial institutions can join the Interledger network. Instead of building their own complex infrastructure from scratch, they can easily leverage the power of ILP through our API.

- Scaling our user acquisition in key emerging markets across Africa, Latin America, and Asia.

- Formalizing peering relationships with other licensed Interledger network nodes to create a fully regulated, interconnected payment network.

We believe that by building this open, inclusive, and efficient global payments infrastructure, we can serve millions of people and businesses worldwide.

Lessons learned and recommendations

Our prototyping phase provided invaluable insights that will guide our next steps:

- Regulatory compliance is foundational, not optional. Our early investment in governance and KYC/AML allowed for faster integrations later.

- Developers want clear APIs and fast integration. Our Dev Portal and Interledger tutorials saw higher-than-expected engagement.

- Users in emerging markets value earn-first wallets more than just sending capabilities.

We will continue to apply these lessons by prioritizing compliance planning, focusing on developer tooling, and tying the ILP value proposition to compelling, real-world use cases.

A Heartfelt Thank you

This journey would not have been possible without the support of the Interledger Foundation. Their faith in our vision and their guidance has been instrumental.

We are also deeply grateful to our amazing team, our dedicated partners, and every user who has believed in us. Together, we are building the future of payments.

If you’d like to partner with Chimoney to build the future of payments, contact our team to discuss how our ILP-powered solutions can transform your business.

Check out these other posts

Why 2025 Is The Year AI Agents Get Their Own Wallets (And Passports)