How Web Monetization with Chimoney Reduces Your Compliance Burden

For online creators, monetizing content is increasingly complicated by a dense web of data privacy regulations like General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA). Traditional revenue models, particularly advertising and subscriptions, often require the collection, storage, and protection of extensive user data, increasing the compliance burden and operational risk for creators.

This blog post explores how Web Monetization, implemented through a compliant-first platform wallet provider like Chimoney, offers a powerful alternative that reduces this compliance surface area through its privacy by design architecture. We will demonstrate how creators can access a new, global revenue stream while simultaneously enhancing their data privacy posture, turning a potential compliance liability into a competitive advantage.

The Compliance Challenge of Traditional Monetization

Before exploring the solution, it's essential to understand the compliance challenges inherent in today's dominant revenue models.

-

The Advertising Model: This model is fundamentally reliant on tracking user behavior across the web. To serve targeted ads, creators must deploy cookies and other tracking technologies, which requires them to manage complex consent banners and data processing agreements. This creates a significant compliance surface area and introduces privacy risks for users.

-

The Subscription Model: When a creator offers a subscription, they typically become a "data controller" for their customers' Personally Identifiable Information (PII). They are responsible for securely collecting and storing sensitive data such as names, emails, and payment information (like credit card details). This carries the significant overhead of managing customer records, implementing robust data security, and handling potential data breaches, all of which fall under strict regulatory scrutiny.

Web Monetization's Privacy by Design Architecture

Web Monetization offers a fundamentally different approach that prioritizes user privacy and minimizes data collection for the creator.

Anonymity as a Feature

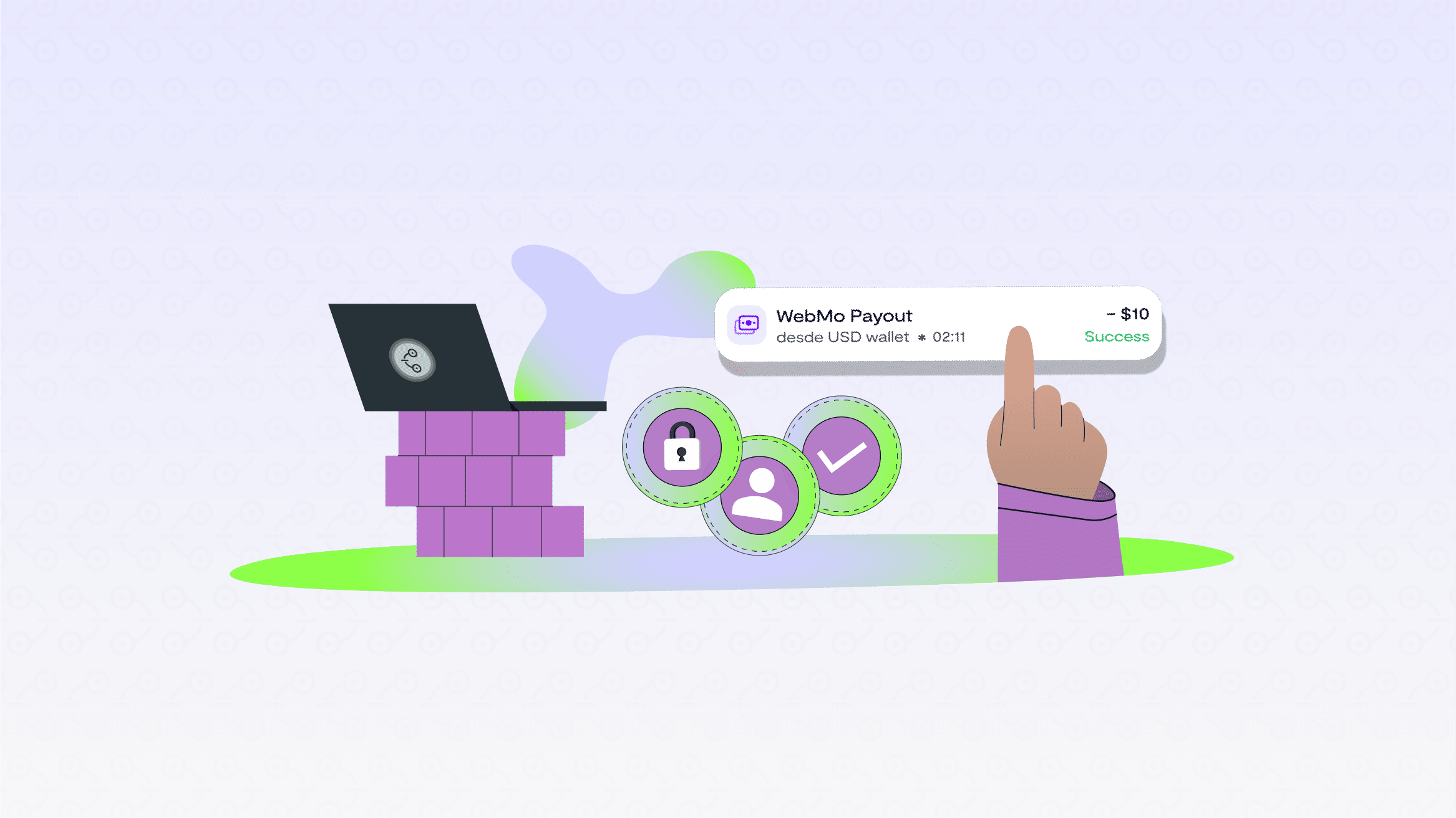

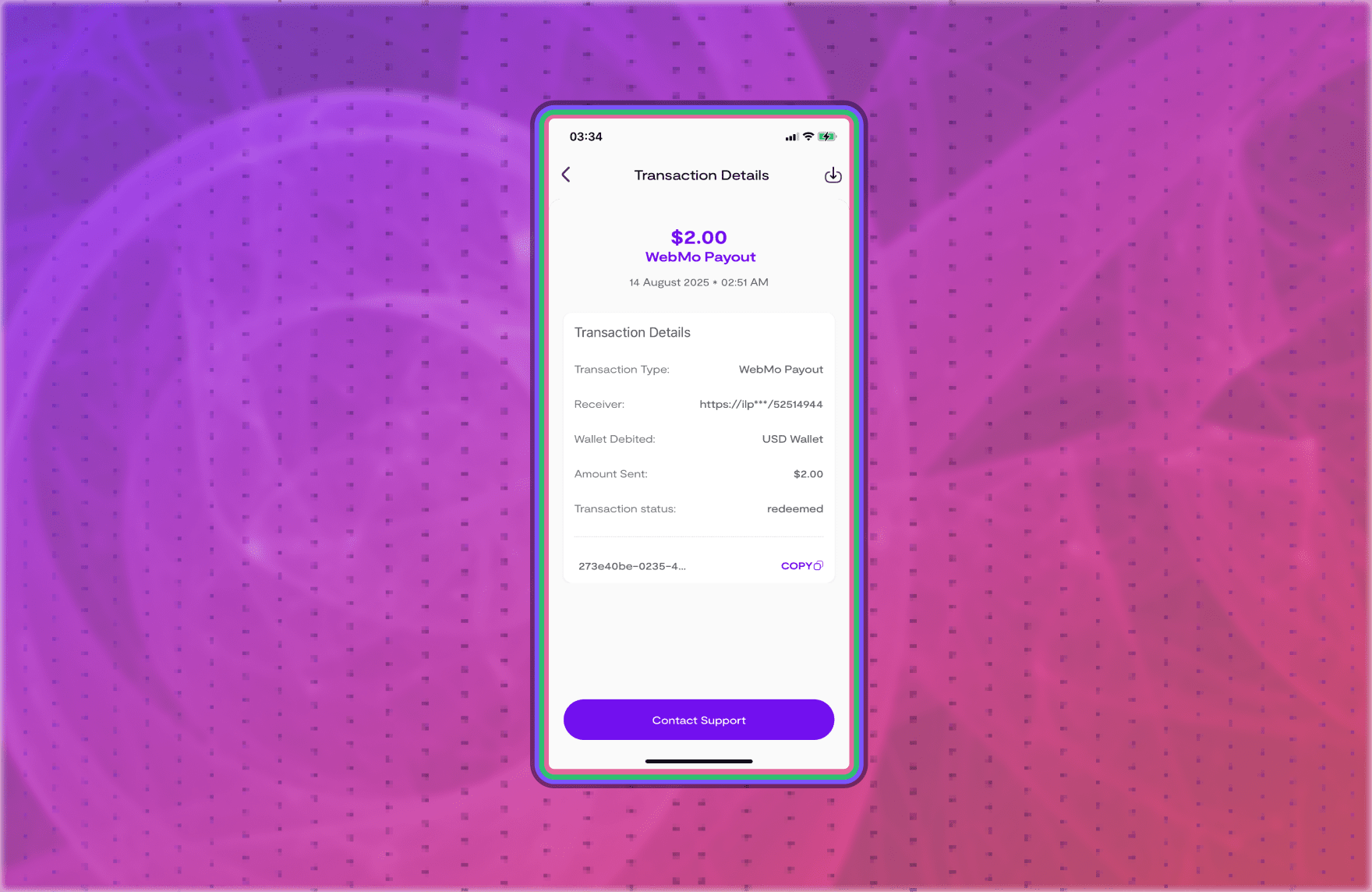

The core principle of Web Monetization is that payments are anonymous to the receiver. When a supporter streams a payment, the creator's transaction history shows a "WebMo Deposit" originating from the supporter's non-personally identifiable wallet address. The creator does not receive the supporter's name, email, IP address, or any other PII that could be used to directly identify them.

This directly aligns with the core data privacy principle of data minimization. The creator receives the value they need—the payment—without collecting or processing personal data that is unnecessary for the transaction, thereby reducing their regulatory responsibilities.

The Role of a Regulated Provider: How Chimoney Manages Compliance

The privacy and anonymity of Web Monetization powered by Interledger protocol does not mean a lack of security or accountability. Instead, the compliance responsibilities are shifted to the regulated wallet providers who are equipped to handle them. This creates a crucial separation of concerns.

Mandatory Identity Verification (KYC)

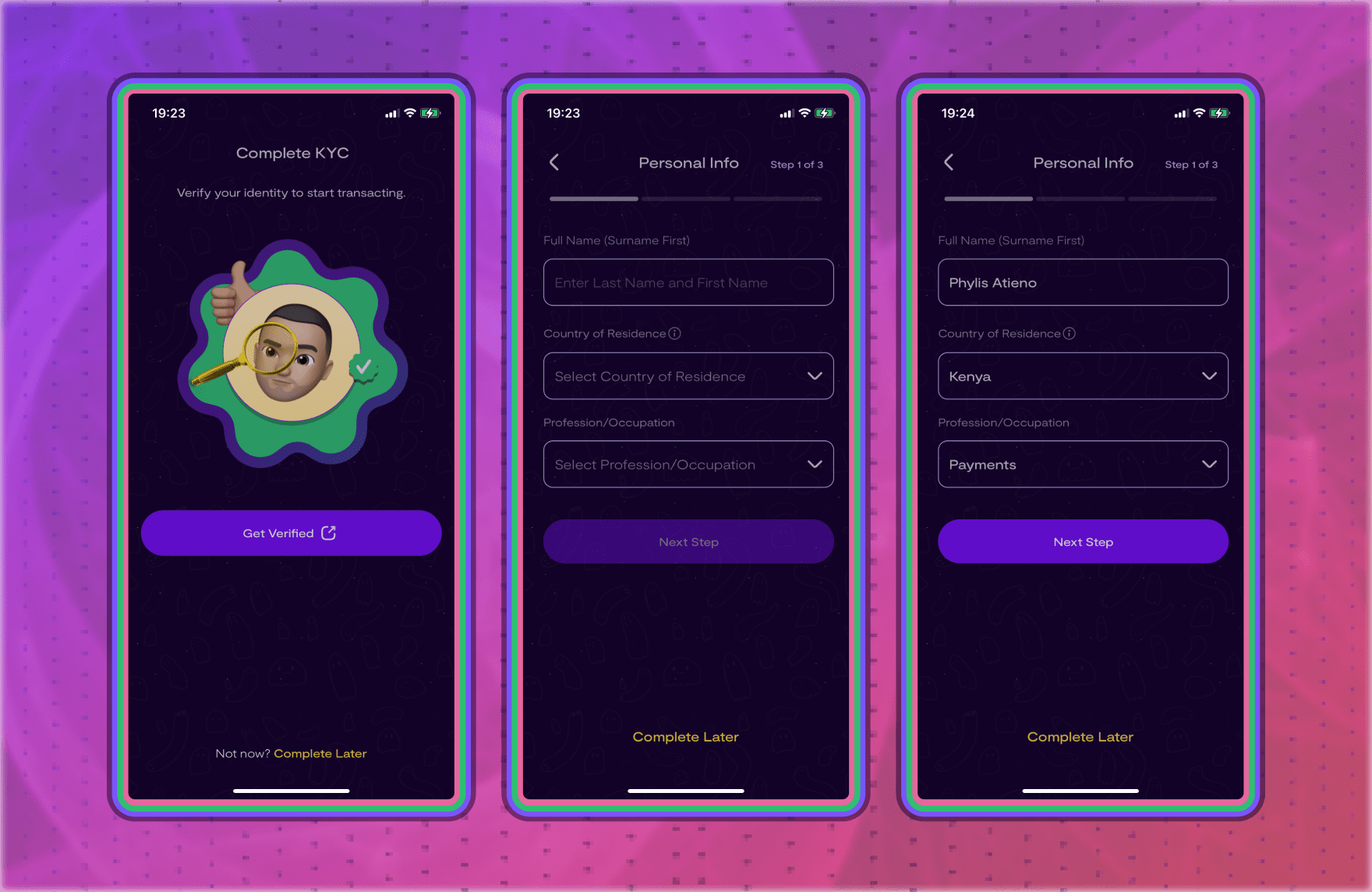

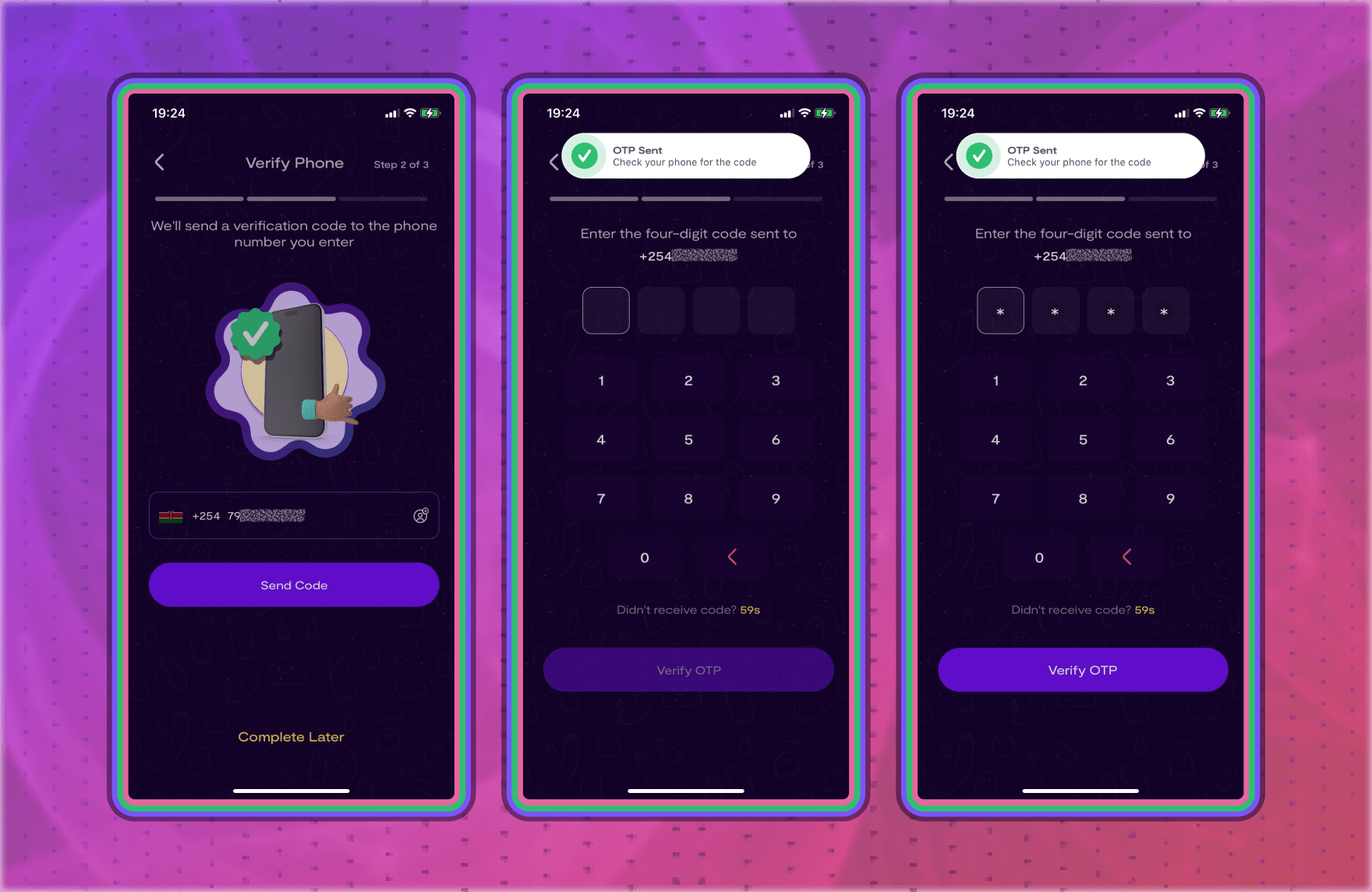

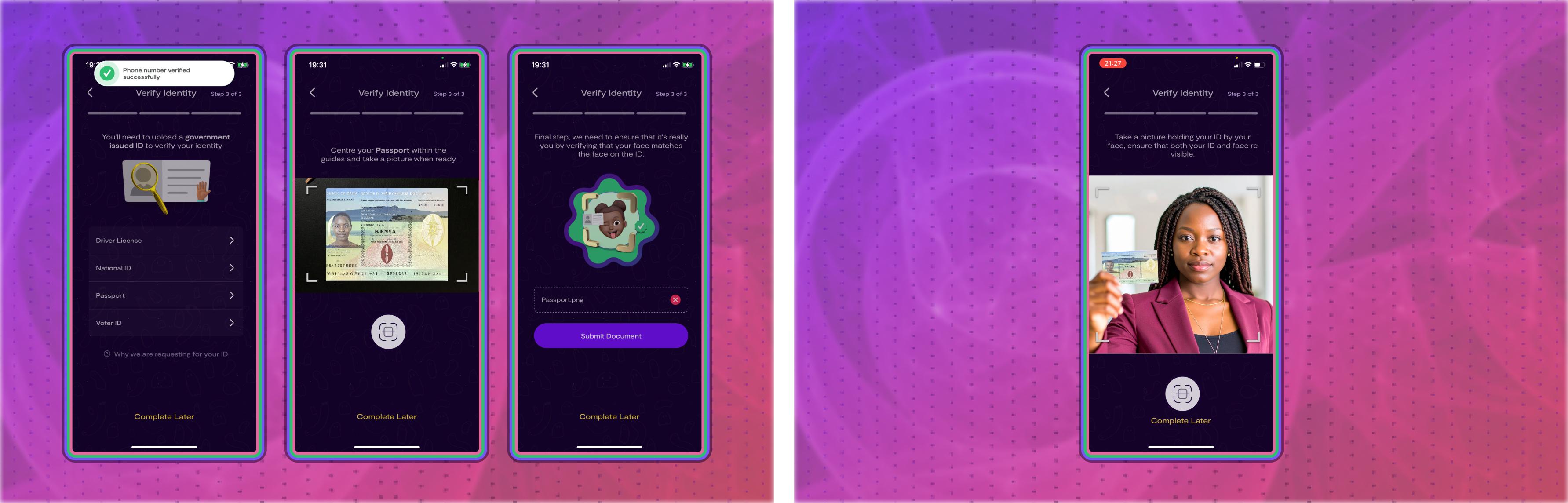

Before any user—whether a supporter or a creator—can send or receive funds using the Chimoney App, they must complete a mandatory Know Your Customer (KYC) identity verification process . This multi-step procedure involves:

- Providing personal information like full name and country of residence.

- Verifying a phone number via an OTP code.

- Uploading a valid government-issued ID and taking a verification selfie holding the ID.

This robust, initial verification ensures that all participants in the ecosystem have been identified in accordance with global Anti-Money Laundering (AML) and financial compliance standards.

The Separation of Concerns

This is where the model becomes so powerful for businesses. Chimoney, as the regulated financial entity, performs and manages the KYC/AML checks and maintains the secure link between a user's real-world identity and their digital wallet address.

The content creator, however, operates at a layer of abstraction above this. They are shielded from the need to conduct KYC on their thousands of potential supporters or to handle sensitive identity documents. Their role is simply to receive a payment from various verified supporters'. This structure allows the system to be both globally compliant and privacy-preserving. While the creator-supporter interaction is anonymous, the system remains auditable, and a regulated provider like Chimoney can comply with lawful requests from financial authorities.

A Practical Comparison

| Compliance Task | Traditional Subscriptions | Web Monetization with Chimoney and Interledger |

|---|---|---|

| User Data Stored by Creator | Full Name, Email, Payment Info (PII) | None. Only a non-personally identifiable wallet address is seen in transaction logs. |

| KYC/AML Responsibility | Falls on the Creator and/or their Payment Processor. | Handled entirely by Chimoney as the regulated wallet provider for all users. |

| Data Privacy Risk | High. The creator is a data controller for sensitive user information. | Low. Data exposure is minimized, reducing the creator's role as a data controller for financial PII. |

| Compliance Overhead | High. Requires managing user consent, data security policies, and potential breach responses. | Low. The creator leverages Chimoney's existing compliant infrastructure to get paid. |

Conclusion

Web Monetization powered by Chimoney and Interledger is more than just an innovative revenue model; it's a strategic choice for modern, privacy-conscious businesses. By separating the act of payment from the exchange of personal identity and shifting the compliance burden to a dedicated, regulated provider, creators can dramatically reduce their risk and operational overhead. This "privacy by design" approach allows creators to focus on what they do best creating valuable content while offering their audience a more private, secure, and seamless way to show their support.

Check out these other posts

Why 2025 Is The Year AI Agents Get Their Own Wallets (And Passports)