Digital Compliance and eKYC Pave the Way for a Safer Global Financial Ecosystem

Financial institutions (FIs) of all sizes across the globe have digitally transformed to improve their customer experience, boost operational efficiencies, and keep their customers safe. The next step is to leverage the significant strides made in digital compliance.

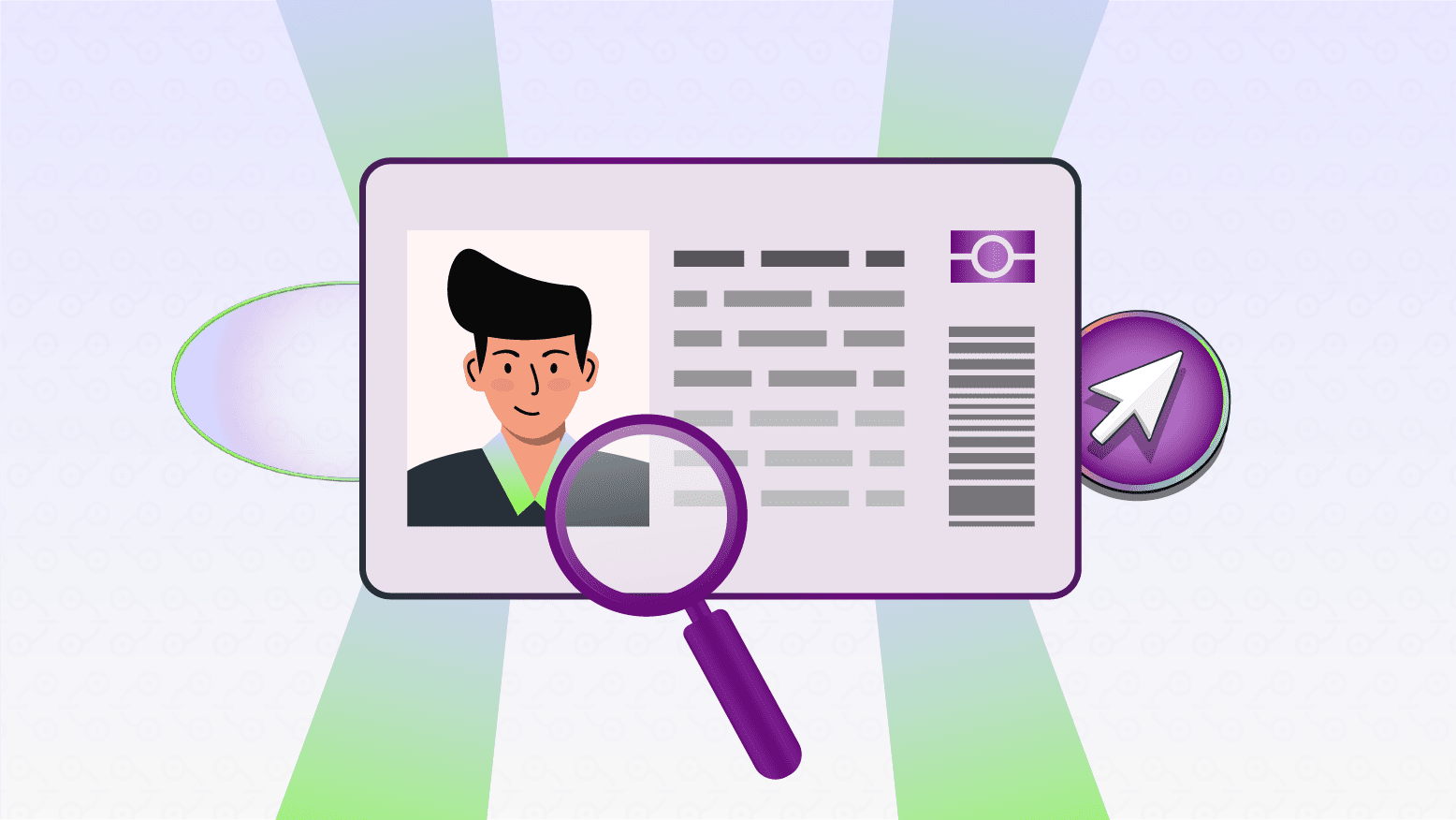

eKYC (electronic Know Your Customer) is rapidly being adopted worldwide, with both developed and emerging economies implementing technologies such as digital identity verification to streamline onboarding and improve financial inclusion. Governments and financial institutions are also leveraging eKYC to improve access to banking, reduce fraud, and comply with Anti-Money Laundering (AML) regulations, and eKYC is seeing particularly robust growth in countries that are rolling out digital ID initiatives.

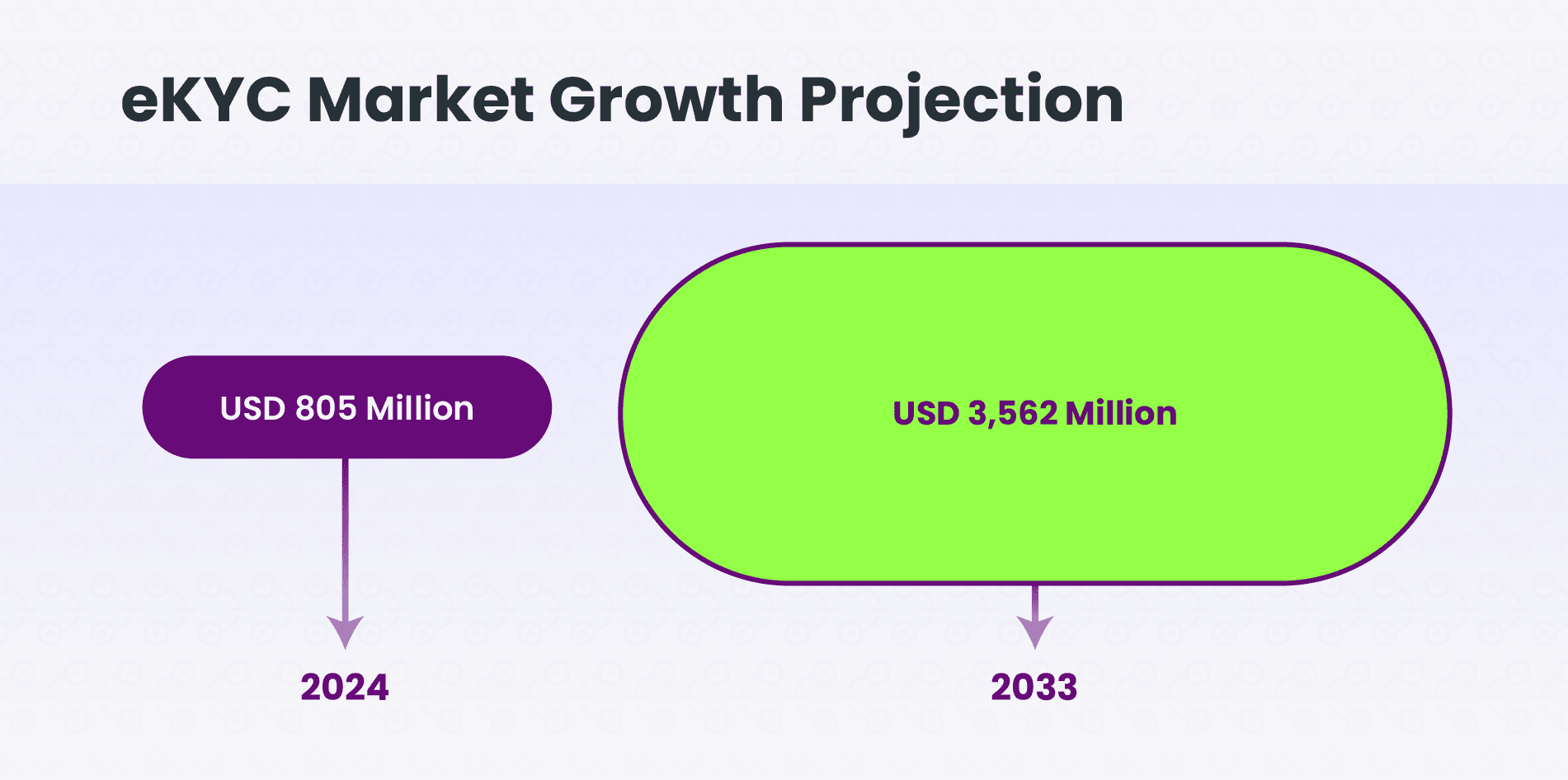

In 2024, the global eKYC market size was valued by the IMARC Group at USD 805.8 million, and looking ahead, the company estimates the market to reach USD 3,562 million by 2033, showing a CAGR (Compound annual growth rate) of 17.74% during the period.

At Chimoney, we've positioned ourselves at the forefront of this transformation. As a fintech company simplifying global payments and enabling seamless cross-border financial transactions, we've developed a comprehensive eKYC and anti-money laundering solution that reflects our commitment to both innovation and compliance.

We're setting a new standard in digital compliance by integrating eKYC with advanced financial technology infrastructure. This allows us to offer bankless financial services while maintaining anti-fraud protections, and we see it as a necessary evolution for fintechs navigating increasingly stringent regulatory landscapes.

These advancements come at a crucial time, as the importance of robust financial compliance is being underscored by global regulatory crackdowns such as the significant fine recently levied against TD Bank for AML failures.

Creating a Digital Compliance Ecosystem

At Chimoney, our approach is rooted in a multi-layered technological framework that combines artificial intelligence, real-time monitoring, and advanced verification techniques. We've created a digital compliance ecosystem that surpasses traditional methods, offering a smart, adaptable system that evolves alongside emerging financial threats.

The backbone of our platform is a sophisticated AI-powered verification engine. Unlike legacy systems, ours enables instant document validation, automated cross-checking against global databases, and real-time fraud detection, all built for scale and speed.

By leveraging machine learning algorithms, our system constantly refines its ability to spot suspicious transaction patterns, creating a proactive, rather than reactive, approach to financial security.

Chimoney's eKYC verification process begins with advanced ID checks powered by our proprietary technology, incorporates video-based liveliness detection, and cross-references user data against global sanctions and watchlists. Each user is then subject to a thorough manual review by our compliance team because at Chimoney, we believe technology should empower, not replace, human judgment.

Our system goes far beyond verification. We've engineered it to detect complex money laundering strategies, flag unusual transaction behavior, and deliver comprehensive compliance reporting. For financial institutions, this means compliance isn't a bottleneck but a competitive edge.

By analyzing data such as transaction frequency, speed, value, and origin, our AI can flag suspicious activity nearly in real time. This approach marks a decisive step forward from traditional, retrospective methods.

Collaboration as a Catalyst for Safer Finance

Collaboration is at the heart of Chimoney’s ethos. Banks sharing AML information can significantly enhance the integrity of the global financial system, helping organizations detect and prevent financial crimes.

Currently, many financial institutions operate in silos, limiting visibility into broader suspicious activity patterns. But with advanced eKYC systems like ours, equipped with AI and machine learning, it becomes possible to create more unified, intelligent monitoring systems capable of detecting complex financial crimes across institutional boundaries.

Building the Future Together

Our continued commitment to compliance, combined with adherence to Canadian regulatory requirements—namely compliance with FINTRAC (Financial Transactions and Reports Analysis Centre of Canada), the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), and the Retail Payment Activities Act (RPAA), strategically positions us to strengthen our platform through regulatory alignment, increased trust, and scalable innovation.

Looking ahead, we're focused on enhancing pattern recognition, refining behavioral analytics, and integrating more external data sources to deliver even deeper risk assessments.

As financial crimes become increasingly sophisticated, our approach demonstrates the critical role of technology in maintaining financial integrity. By leveraging artificial intelligence, advanced verification techniques, and innovative compliance solutions, we are showing what is possible with a great digital compliance foundation.

Check out these other posts

Why 2025 Is The Year AI Agents Get Their Own Wallets (And Passports)